Amendment by section 1506b1 of Pub. And iv trade price and the method used to.

18 References to section 2033A of the internal revenue code in wills trust agreements powers of appointment beneficiary designations and other instruments governed by or subject to this title are deemed to refer to the comparable or corresponding provisions of section 2057 of the internal revenue code as added by section 6006b of the.

. Introduction to sections 346 and 347. 3 seek under Section 33-44-8015 a judicial determination that it is equitable to dissolve and wind up the companys business. Asset-based income tax regime has the meaning given by section 830- 105.

F A limited liability company need not give effect to a transfer until it has notice of the transfer. B the beneficial owner of shares issued by a for-profit corporation whose shares are held in a voting trust or by a nominee on the beneficial owners behalf to the extent of the rights granted by a nominee statement on file with the for-profit corporation in accordance with. Additional deduction under section 1149 of CTA 2009.

Relief after an exchange of shares for shares in another company. As used in NRS 78191 to 78307 inclusive unless the context otherwise requires the word distribution means a direct or indirect transfer of money or other property other than its own shares or the incurrence of indebtedness by a corporation to or for the benefit of all holders of shares of any one or more classes or series of the. Tax credit under section 1151 of.

Assessment day for an income year of a life insurance company has the meaning given by section 219- 45. Asset entity has the meaning given by section 12-436 in Schedule 1 to the Taxation Administration Act 1953. The number of shares or units traded.

5 A corporation shall not transfer shares held under subsection 4 to any person unless the corporation is satisfied on reasonable grounds that the ownership of the shares as a result of the transfer would assist the corporation or any of its affiliates or associates to achieve the purpose set out in subsection 4. Such transaction is expressly permitted by the instrument under which the plan is maintained or by a. 10534 applicable to taxable years beginning after Dec.

Asset included in the total assets of a company that is a foreign. Transfer of field allowance. Iii the parties involved in the cross-trade.

Structural Basis Of Sarm1 Activation Substrate Recognition And Inhibition By Small Molecules Sciencedirect

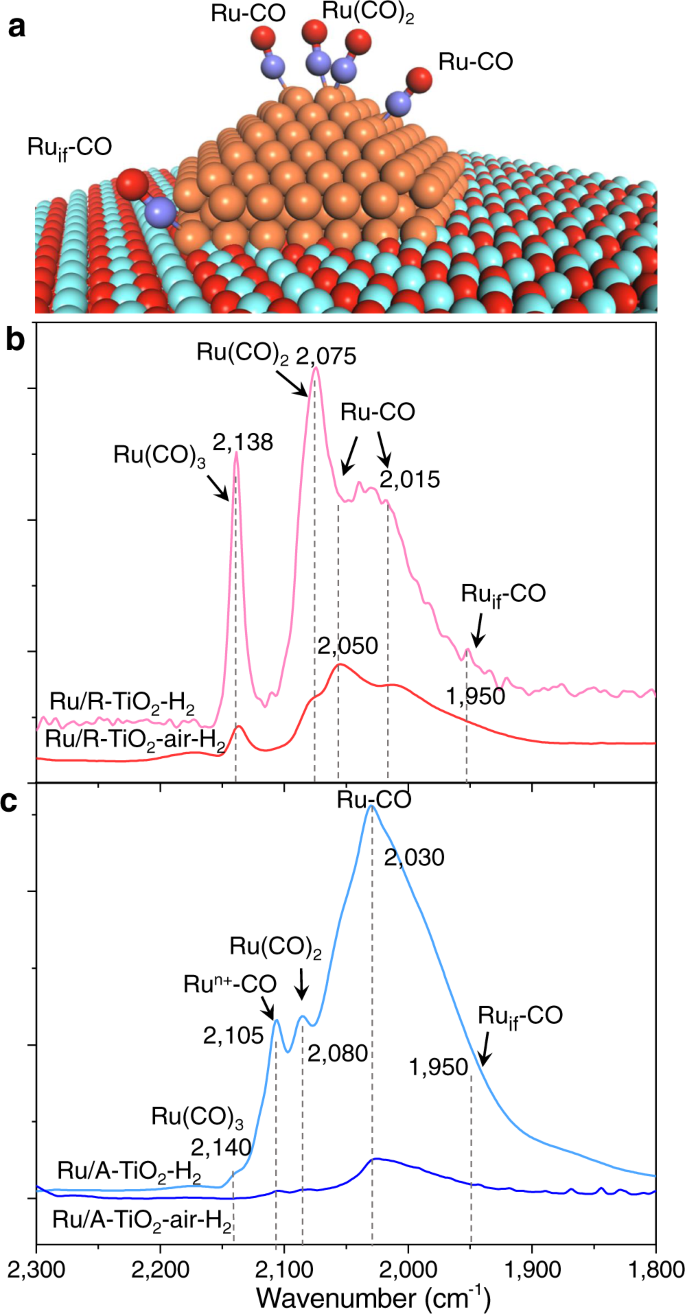

Interfacial Compatibility Critically Controls Ru Tio2 Metal Support Interaction Modes In Co2 Hydrogenation Nature Communications

ボード Coca Cola Stock Certificates Aktien Akcie Scripophily Azpartner1 のピン

Recent Advances And Challenges Of Waveform Based Seismic Location Methods At Multiple Scales Li 2020 Reviews Of Geophysics Wiley Online Library

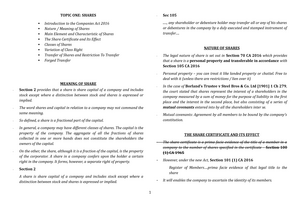

Section 105 Instrument Of Transfer Of Shares Nashcxt

Section 105 Instrument Of Transfer Of Shares Nashcxt

Company Registration In Bahama Islands Business Starting Setup Offshore Zones Gsl

Disruption Of Financial Intermediation By Fintech A Review On Crowdfunding And Blockchain Cai 2018 Accounting Amp Finance Wiley Online Library

Structural Basis Of Sarm1 Activation Substrate Recognition And Inhibition By Small Molecules Sciencedirect

Lipid Nanoparticle Encapsulated Mrna Vaccines Induce Protective Memory Cd8 T Cells Against A Lethal Viral Infection Molecular Therapy

Percp Cy 5 5 Rat Anti Mouse Cd8a

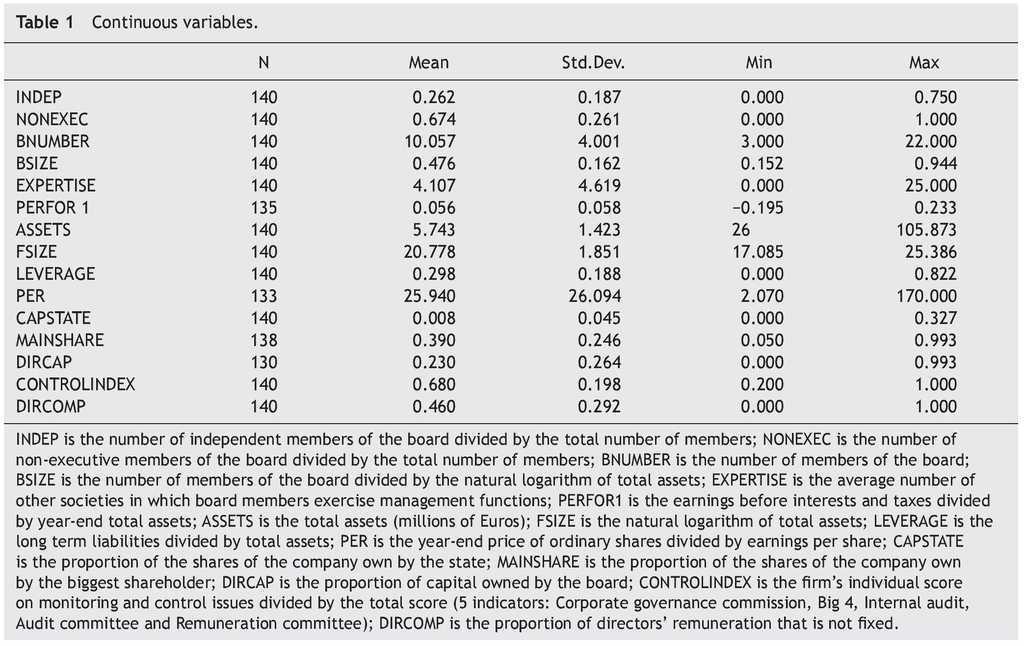

Factors Influencing The Different Categories Of Voluntary Disclosure In Annual Reports An Analysis For Iberian Peninsula Listed Companies Tekhne Review Of Applied Management Studies

Cross Kingdom Expression Of Synthetic Genetic Elements Promotes Discovery Of Metabolites In The Human Microbiome Sciencedirect

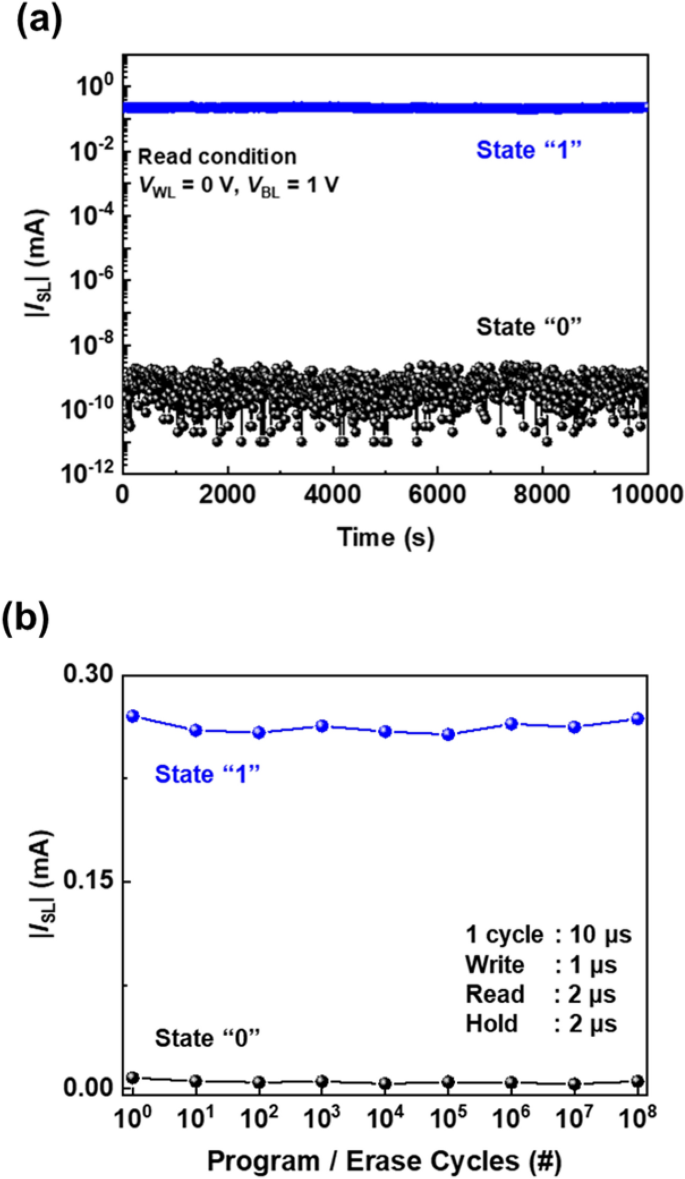

One Transistor Static Random Access Memory Cell Array Comprising Single Gated Feedback Field Effect Transistors Scientific Reports

Eur Lex 52021sc0320 En Eur Lex